Hop Press

Issue 89 – Lockdown 2021

Go to Previous Hop Press Browse for another Hop Press

Go to Next Hop Press

Hop Press is normally a paper publication, distributed to pubs, but once again there are no pubs open so there's no paper version of Spring 2021 Hop Press. But we do have Pubs News which we will show below on-line only. Being on-line the content can be dynamic, so pop back now and again to see what we've added – articles will have dates.

Contents

- Southampton Late Night Levy - 12/04/2021

- Pub News - 01/02/2021

- Beer in the UK – a briefing by Tim Web 15/02/2021

- Non-Competition Crossword - 24/03/2021 [With correction to 3 down 17/04/2021]

Southampton Late Night Levy Hop Press index

Introduced under the Coalition Government, the Police Reform and Social Responsibility Act 2011 enabled licensing authorities to raise a contribution from late-opening alcohol suppliers towards policing the night-time economy. The Levy came into force in October 2012. The aim of the policy was to empower local areas to charge businesses that supply alcohol late into the night for the extra enforcement costs that the night-time economy generates for police and licensing authorities. It is a local power that licensing authorities can choose whether or not to exercise.

Southampton City Council introduced the Late Night Levy in 2015. When a licensing authority introduces the Levy in their area, all licensed premises which are authorised to supply alcohol in the Levy period are affected. This meant that as well as city-centre nightspots, such as those in the Above Bar and the Bedford Place areas, locals pubs in residential areas were also affected if they had a late licence that included trading within the hours included in the local conditions. Premises that do not wish to operate in the Levy period are able to make a free minor variation to their licence before the Levy is introduced. We believe that a few premises did make this change when the Levy was introduced in Southampton.

The licensing authority can choose the period during which the Levy applies every night, between midnight and 6am, and decide what exemptions and reductions should apply from a list set out in regulations.

Under the national guidelines, the council decided that seven categories of premises were exempt:

- Premises providing overnight accommodation

- Theatres

- Cinemas

- Bingo halls

- Registered community amateur sports clubs

- Certain community premises

- All premises on New Year’s Day

In Southampton the Levy, which is an annual charge, would be paid by licensed premises selling alcohol between 00:01 and 06:00 hours. The Levy is a tax, not an additional licence fee.

The annual payment levels are set nationally and are based on rateable value. For larger premises, the levy charged also varies depends on whether they are, “Premises which are used exclusively or primarily for the supply of alcohol for consumption on the premises.” The annual amounts charged are £299 for premises in rateable band A to £4,440 for band E premises which are used exclusively or primarily for the supply of alcohol for consumption on the premises.

National guidelines decree that 70% of the money raised goes to the police. In 2018-19, the last year for which figures are available, the distribution of the remaining 30% in Southampton was as follows:

- Taxi Marshalls: £15,000

- Street Pastors: £25,000

- Community safety: £5,144

- Street cleansing: £25,000

- CCTV: £25,000

The Levy was discussed at a council meeting in November 2020. In a paper presented at the meeting, it was noted that in 2017 a Business Improvement District (BID) was established in Southampton. GO! Southampton is led and funded by local business and aims to realise Southampton’s untapped potential. The BID covers the city-centre area and 49 premises are subject to both the Late Night Levy and paying contributions the BID. https://www.southampton.gov.uk/modernGov/documents/s48047/Appendix%202.pdf

The report continues, “Whilst the Levy has been beneficial in supporting measures to reduce anti-social behaviour and support community safety, the council recognises the impact COVID19 has had on businesses and that it is contradictory to impose such a Levy at a time where there is no night- time economy…The council, with the BID, aims to continually work with businesses to ensure that the needs of business and the safety of our residents are a priority. If this means consideration to re-introduce the Levy in the future, the council will take this step after undertaking the necessary consultation.” The recommendations were passed unanimously by the council and the Levy ended on 1 April 2021.

Thus although the late night Levy has ended for the time being in Southampton, there is the possibility that it could be reintroduced in the future. Further details can be found at: https://www.southampton.gov.uk/business-licensing/licensing/licensing-act-2003/late-night-Levy.aspx

Pub News January 2021 Hop Press index

With the constantly changing situation facing our pubs, we are endeavouring to keep readers up to date with the latest situation regarding trading at individual outlets on the pages of CAMRA’s national pub database WhatPub

Some pubs have been mentioned in the media as being “permanently closed”. However, where the pub is owned by a large pub chain, this could mean that the current leaseholder will not reopen the pub rather than the owner deciding to close the pub on a permanent basis.

Below we will mention the proposed opening date for some new ventures. Obviously, these could change depending on the COVID guidance pertaining at the time.

While we can only wait to see what the pub scene will look like in the coming years, there have been a number of structural and ownership changes over the last few months which we report on below.

Royal Oak, Hill Top

Emery Down, Hilltop and Minstead

We start with some good news from the Forest, where well-known publicans Duane and Debbie Lewis have obtained the freehold of three of the pubs that they run. The pubs are: the New Forest Inn at Emery Down, near Lyndhurst, the Royal Oak at Hilltop near Beaulieu and the Trusty Servant in Minstead. Further good news for Minstead residents is that a new village shop has opened in part of the Trusty Servant buildings. The village’s previous shop closed in 2018.

Marchwood

As we reported in the last Hop Press, an application was submitted to convert the former skittle ally into four letting rooms at another of the pubs run by Mr and Mrs Lewis, the Bold Forester in Beaulieu Road, Marchwood. The application was rejected by the New Forest National Park Authority, despite there being only one letter of objection and getting the support of Denny Lodge Parish Council. An appeal against the decision has now been lodged.

Linwood and Ringwood

Two other western New Forest pubs have changed ownership. In December the High Corner Inn, Linwood and the Fish Inn, Ringwood were among 21 pubs sold by Wadworth to Channel Island based Liberation Group. Liberation also owns Butcombe Brewery, Somerset, which it purchased in 2015. Butcombe beers appear to have replaced those from Wadworth on the bar.

Note also, as with many other plans for breweries and other businesses, Wadworth’s proposal to move production from its classic Devizes Victorian brewery to a new site has been put on hold.

Staying in Ringwood, the merger between Marston’s and Carlsberg UK to form the Carlsberg Marston’s Brewing Company was given the go ahead after an investigation by the Competition and Markets Authority. We hope that the Marston’s owned Ringwood Brewery will continue to brew and possibly find additional distribution opportunities. Marston’s pub estate was not included in the deal.

During the first lockdown landlord of the London Tavern in Poulner, Phil Hoyle, and his team provided free roast dinners for NHS staff and started a take-away food service for his customers. Just one of many pubs in our area and beyond who did such a sterling job. In November, however, the pub was hit by thieves who caused more than £1,000 of damage and stole 50 bottles of spirits. Locals started a fundraising appeal to pay for the repair of the damage. In a reflection of the popularity that Phil and his partner Sarah have built at the pub since taking over some two years ago, more than enough to cover the repairs was raised. The excess will be used to install a defibrillator, to be sited at the pub and to be on hand for anybody in the community that may require it. The pub has received a British Institute of Innkeeping Heart of the Community award for its efforts during the COVID period.

Royal Oak, Fritham

Fritham

The esteemed Royal Oak at Fritham has won yet another award. It has been named Country Pub of the Year by the Good Pub Guide. The pub also won the award in 2012. Congratulations to Neil and Pauline McCulloch and their family.

Sway

A request to use the rear patio area of the Silver Hind in Sway between 11:00 and 22:00 was refused by New Forest National Park planners. The erection of an acoustic fence was part of the application.

More successful was an application to make various structural and lighting changes for the Mill at Gordleton, which was granted, subject to conditions.

Lymington

The application for various architectural changes and the installation of a brewery at the Monkey House on the edge of Lymington was granted by New Forest planners. There are various conditions attached, many referring, “To ensure an acceptable appearance of the development, and to safeguard the character and appearance of the Buckland Conservation Area and associated heritage assets…”

A planning request to build three terraced houses following the demolition of a property next to the Borough Arms was withdrawn. There were eleven objections to the plan, including one from the pub.

The Wheel Inn in Pennington, which reopened as a community run pub in March 2018, went on the market in July. The Community Benefit Society that was running the pub said at the time that the pub was no longer viable, given the effects of the various COVID restrictions.

The Thomas Tripp reopened under new ownership in in the autumn. It has been taken on by local chef Joe Hibberd and his business partner Henry Fry. The aim is to have one area operating as a restaurant and another as a bar area where customers will be able to enjoy snacks. It is also planned to add accommodation, with the aim of renting it out through Airbnb. The name of the pub has changed to the Saltern and the pub’s website describes it as “… a neighbourhood Restaurant, Pub and Bottle shop.”.

Walhampton

The planning application for various structural changes at the Walhampton Arms, which we mentioned in the last Hop Press, was approved. The plans included six new letting rooms and a new cellar. Gavin and Georgia Hawkins took over the pub in March.

Keyhaven

Licensees of the Gun Inn, Keyhaven, Paul and Jacqueline Hill have retired after 33 years at the pub. They were given a warm send-off by locals and regulars in October and the couple plan to stay in the area. We expect the pub to reopen following some renovation work.

Milford-on-Sea

As previously reported, planning permission had been granted to construct three houses on land to the rear of the White Horse, Milford-on-Sea. Now the developers have come back with an application to replace a four-bedroomed house in the agreed plans with a pair of three-bedroomed semi-detached homes. A previous application to build four houses on the site was rejected.

Rosie Lea, Battramsley

Battramsley

The Hobler at Battramsley reopened in July as Rosie Lea, a tearoom, restaurant and bar. Owner Rachel Rabbetts has taken on a “free of tie” tenancy with Ei Group. As a result, Rachel is able to offer locally produced beers, spirits and wines.

Brockenhurst

Permission has been granted to build an extension and new buildings to create 38 new rooms at the Balmer Lawn Hotel. The current look of the building dates back some 50 years, when a fire caused some £90,000 (more than £1m at today’s prices) of damage in the autumn of 1970. During the repairs the original roof was replaced with one in the mansard style. The hotel is home to the Brockenhurst Brewery, a microbrewery based at the rear of the hotel. An American style pale ale, Henry’s Pale Ale, (HPA) was brewed to follow up Smokin Deer Bitter.

As previewed in the last Hop Press, new outlet Commoners Wine Bar opened during the summer. The Brookley Road premises has replaced two shops and the previous frontage has remained intact. Though the emphasis is on wine and food, there are two handpumps on the bar, with one offering Ringwood Best at the time of opening.

New Milton

In August the Willow Barn in Gore Road, New Milton reopened as The Barn. New owner Charles Bruske, who has 30 years’ experience in the hospitality industry, wants to make full use of the size of the premises to host events such as weddings and birthday parties.

Ashford nr Fordingbridge

The Augustus John reopened in late Autumn under its new (old) name of the Railway Hotel. Among the many changes is the addition of five en-suite rooms, all with their own distinctive interiors inspired by iconic train journeys, and a self-contained two-bedroom cottage set around a magnificent courtyard.

There could be more locals in the pub’s catchment area in the future if permission is granted to build new housing on land north of Station Road, close to the Railway Hotel. The application has attracted more than 100 objections. Some objectors may have been concerned that the outline planning permission request was submitted by a company named Infinite Homes Ltd.

Brook

The Bell Inn at Brook and adjoining golf course were put up for sale at an asking price of £4.5m during the summer. The Bell is Grade II listed and has 28 bedrooms.

Sir John Barleycorn, Cadnam

Cadnam

The Sir John Barleycorn at Cadnam reopened in December under new management. It was one of a number of pubs that closed following the conviction of previous owners for tax fraud. We are pleased to say that the outlets in our area are all now trading again, when COVID rules allow.

Ashurst

During the summer new landlady Joanne Laver and her partner Ian Vass moved into the Forest Inn at Ashurst. Joanne was at one time a regular at the pub and as part of the refurbishment of the premises, the exterior was returned to the cream and black colour scheme.

Winsor

The Compass Inn at Winsor hit the headlines in September when long-standing landlady, Mop Draper, introduced new conditions on who was allowed to visit the venue. The pub’s website states, “ADULTS ONLY (Well behaved Teenagers accepted) Families with young children can book a table on Sunday lunchtime only.” Other features such as a gluten free menu and welcoming dogs remain unchanged.

Eling

The Asset of Community Value (ACV) listing for the King Rufus at Eling has been renewed by New Forest District Council. ACVs last for five years, so this was a renewal for the registration that was first agreed in 2015.

Hythe

A planning application has been submitted for a micropub in the centre of Hythe. It would occupy the premises that was previously trading as “Best Buys” in the pedestrianised area of The Marsh in Pylewell Road. The application states that, “Our aim is to create a small craft beer micro pub that will provide great beer in a stripped back industrial/retro setting with friendly staff and great atmosphere for all.” The licensing application for number 5 The Marsh states that the new pub would be called the Dusty Barrel.

Calshot

We previously reported that an application to build seven houses on the on part of the site of the former Flying Boat pub at Calshot was been rejected by New Forest National Park Authority’s planners. Now F B Estates has lodged an appeal to reverse the decision.

Players, Totton

Totton

Permission has been sought for the construction of six houses on the site of Players in Water Lane, Totton. The pub, which was built in the 1930’s, has been closed since early 2017. The Totton and Eling Town Council has backed the plans for the pub that was previously known as the Coopers Arms, but a final decision from New Forest District Council is still awaited.

Romsey

It is difficult to keep up with the applications related to the former Abbey Hotel in Romsey. In October permission was granted for the, “Demolition of toilet blocks to rear and conversion, alterations and extension to provide four dwellings comprising a two-storey two-bedroom house, a three-bedroom maisonette, a two-bedroom and a one bedroom flat; provision of external staircase.” Then in December a further application was submitted for (relatively minor) alterations to the original plans.

Despite the bad news of the loss of the Abbey Hotel, there is good news for Romsey drinkers. The former Boots at 8 Market Place is due to become a micropub called the Cocky Anchor. Planning permission has been granted, which includes a new shopfront and fenestration along with fascia and hanging signs. The managing director of Anchor Real Estate Ltd, Ian Paxton, said that the venue could host up to 40 customers and that the focus will be on drinks rather than food, though snacks will be available. It was hoped to open the venue in February.

The former Santander bank premises at 14 Market Place is due to become a cocktail bar called the Exchange. The bar’s owner, Naomi Randall had hoped to open the new venture in late January.

In August, Patrick Robinson retired from working as a barman at the Old House at Home since 1981. Patrick had a full-time job in the computing department at Southampton University but often worked evening shift at the Love Lane pub.

We mentioned in the last Hop Press that a submission had been made to add 12 bed and breakfast rooms at the rear of the Dukes Head in Greatbridge Road. Permission was granted for the application, which stated that, “The emphasis will be on providing a high-quality restaurant.”

Chilworth

An application to open a Miller & Carter steakhouse in Chilworth was rejected by Test Valley planners. It was to be constructed at Chilworth Golf Club, replacing the existing clubhouse, which would have been replaced had the plans progressed. The Miller & Carter chain is owned by Mitchells and Butlers.

Netley

There should be a new lease of life for an existing food-based pub. Questmap Ltd, the owners of the premises Grange Road that what was trading under the name of the Dancing Goose, have successfully applied for an alcohol licence under the previous name of the Netley Grange. The licence application states that the aim is to, “…replace existing pub with newly converted premises and trade in a similar way but on a more manageable size.” Building work has reportedly already started.

Fair Oak

Permission has been granted for the display of various illuminated and non-illuminated signage and lighting for the George at Fair Oak.

Horton Heath

Lapstone, Horton Heath

A little to the south, the Lapstone at Horton Heath finally reopened in December, having closed in March 2017. During the brief trading period before the imposition of Tier 4, beers from Flowerpots Brewery were on the handpumps and the pizzas were proving popular. A million pounds has been invested in the pub, which has been fully refurbished both inside and out. In the autumn, before the reopening, the pub owners offered parents dropping off children to nearby schools use of the pub’s car park, in an attempt to reduce the congestion on the busy main road.

Further along Botley Road, houses have been built on land adjacent to the Brigadier Gerard. The new buildings should not impact on the operation of the pub.

Hedge End

As previewed in the last Hop Press, Coop Micro Bar in Hedge End opened during Covid-19 lockdown for take-outs, with the bar opening fully 31/07/2020. When fully open it is expected to have 12 craft, cider and lager taps, 3 cask ales and an emphasis on local. It advertises as, “Hedge End’s new home for craft beer, fine wine & spirits.”

Bishop’s Waltham

A retrospective planning application was submitted for the erection of an event marquee to the rear of the Barleycorn Inn, Bishop’s Waltham. At the time of writing the Winchester City Council planning website shows that the decision is still pending.

Curbridge

During the summer a canopy roof was constructed over the outdoor drinking area at the Horse and Jockey, Curbridge. Builders Taylor Wimpey donated £2,500 worth of timber and fittings in support of the pub’s provision of free meals to key workers. In July pub owners Fuller’s applied for a licence for a bar servery for the garden area.

Compton

For many years we have reported on proposal to build a care home on the site of the long-demolished Captain Barnard in Compton. Barchester Healthcare gained permission to build a 62-bed home and nurses’ accommodation in February. Now, following a further application being made, an amended plan has been agreed with planners. The pub closed in April 2008 and the first application to build a care home was submitted later that year.

Three Horseshoes, Bighton

Bighton

The English Partridge at Bighton reopened under its original name of the Three Horseshoes in September 2020 after being closed for nearly 3½ years. Congratulations to all those involved in retaining the pub despite many challenges.

Cheriton

The planning application for structural alterations to the Flower Pots in Cheriton, which we mentioned in the previous Hop Press was granted. There was a subsequent submission for a, “Single storey extension to the public house, including removal of an existing toilet block and marquee to create improved toilets, outside bar and circulation space together with replacement ancillary functions room.” This was granted in November.

Winchester

Alfred's Brewery - Sustainable Business award winner

In the county capital Alfred’s Brewery has been celebrating winning the Sustainable Business category in the Winchester Business Excellence Awards. As well as looking to eliminate waste and increase recycling as part of the brewing and packaging processes, the brewery has teamed up with Zedify for local deliveries.

Permission has been granted to owners Star Inns for structural repairs to a first-floor gable wall at the First In Last Out.

City planners have agreed to the opening of a bar at 9-11 High Street in the premises previously hosting Next. Loungers Ltd is aiming to add to its Cosy Club chain, which already has outlets in Basingstoke, Portsmouth and Salisbury. Though focussed on the food trade, one of the images on the Cosy Club website does appear to feature handpumps in the bar area. Offerings from BrewDog and Bath Ales are mentioned on the Cosy Club’s group menu.

One confirmed closure is Lock Fyne in Jewry Street. Owners Greene King announced in the autumn that they would not be reopening the seafood restaurant, which closed in March 2020. In fact, the whole Lock Fine chain was closed. Staying with the fishy theme, a licensing application was made by the owner of the Fox, Crawley and Bugle, Twyford, Lenny Carr-Roberts for a “traditional, smart” fish and chip restaurant, Shoal Restaurant, in what was Eighteen71 café at the Guildhall. We note that part of Winchester Guildhall is being used as a “Nightingale Court” for civil work such as small claims. So in the absence of the 2021 Winchester Beer and Cider Festival, the serving of pints has been replaced by the serving of justice.

The Stable in The Square was one of 14 of the chain purchased by Three Joes from previous owners Fullers. Three Joes already runs the nearby restaurant in Great Minster Street.

Southampton: Above Bar

Meanwhile in Southampton the Stable in Above Bar appears to be permanently closed, at least under its previous ownership. Next door, in what was Neighbourhood, a sign has proclaimed for a while that a bar and restaurant would be opening in Spring 2021, though we have not been able to uncover any further information on these plans.

Southampton: Bedford Place

During the summer, the owners of Shenanigans in Carlton Place successfully applied to extend the hours during which customers can enter the premises. The trading hours did not change. The applicants pointed out that while the previous restrictions on entry time might have been appropriate for its previous incarnation as a late-night nightclub, they were not required for the current operation, which has a very different clientele.

A major development in the Bedford Place area during the summer was the introduction of a pedestrian and cycle zone area. Motorised traffic was banned from parts of Bedford Place, Carlton Place and Lower Banister Street. The temporary scheme was introduced in August and the trial period could last up to 18 months. There has been a mixed response to the changes from local traders. John Cooney of the Cricketers Arms in Carlton Place was part of the working group and is fully behind the introduction of the scheme. Also offering support was Gary Bennetton, who owns Orange Rooms.

In December an airline themed bar, Mile-High, opened in Vernon Walk. The bar is located above the Orange Rooms in what was previously Room Service. The new bar features aircraft style seating.

Southampton: Shirley

Sports Bar, Shirley

A new Sports Bar has been created at 303-305 Shirley Road. The premises had previously hosted Indian restaurants under the names of Virsa, Nicoles and probably best known, Jewel in the Crown. It did open briefly before the post-Christmas lockdown. Nearby, what was Verde has now become Rio’s.

Southampton: High Street

The last year has seen many applications for housing relating to current or former licensed outlets in the High Street area.

A former sports bar, Liberty’s in the city High Street, could see 12 flats on the first and second floors if planners give to go-ahead.

A decision is awaited on an application to build 72 flats to the rear of the Dolphin Hotel. The former Bank of England building that at one time hosted Walkabout and later Elements and Wahoo, was put up for sale in the autumn with a guide price of £3 million. There is current planning permission for the site for retail units and housing.

Southampton: Oxford Street

What was Caskaway in Oxford Street was renamed OX:47 Lounge in October. The emphasis is now more towards to cocktail bar rather than the previous emphasis on craft beer.

There will be another change at No1 Oxford Street after plans to open a new bar and takeaway were given the go-ahead by the city’s licensing committee. The plans include the provision of live music and belly dancing at the venue.

Southampton: Millbrook

The Bricklayer’s Arms in Millbrook underwent a £85,000 refurbishment during the summer. The changes included new furniture, carpets and bar plus a new cellar system.

Southampton: Portswood

Wild Lime in Portswood changed its name to The Broadway during the summer following a refurbishment. It remains under the same ownership.

Southampton: Northam

Prince of Wales, Northam

We were sad to hear of the passing of well-known Southampton publican Joe Smith, who died in the Autumn. Joe took over the Prince of Wales in Northam from his parents in 2010, having previously run other pubs including the Canute, near Ocean Village and the Hope and Anchor in Freemantle. Joe was a big Saints fan and red and white featured strongly at his funeral. We pass on our condolences to his family and wish Joe’s daughter Anneliese all the best in running the Prince of Wales in the future.

If you have any news about pub openings, change of landlords, closures, or other interesting news, let us know at pubinfo@shantscamra.org.uk

Beer in the UK – Issue 1 Reflections on Q1 2020 Hop Press index

The setting

Globally, the beer brewing business produces just shy of 2 billion hectolitres per annum (hl pa), and makes up roughly 5% of the world's economy. It is in effect a single, integrated international business, with even the smallest local brewery having the potential to use existing supply chains to sell its beers anywhere in the world where sale of alcohol is legal.

This report deals with beer production and sales in the UK only.

Back in 1980 the UK produced 67 million hl of beer, around 88% of which was sold in the on-trade, mostly in pubs. By 2019, the amount of beer produced had fallen by one-third to 46 million hl, the proportion sold in the on-trade had fallen to just 46%, and was continuing to fall by around 2% a year.

The beers sold can broadly be divided into

- big brands from big breweries;

- beers from independent breweries; and

- imported beers.

Big brands from big breweries

General points:

The brewery companies with actual or near global span are AB InBev (Budweiser, Stella, Corona and many more: global production 561 million hl pa in 2019), Heineken (2nd largest: 241 hl pa); Carlsberg (4th: 112); and Molson Coors (5th: 93)

The 3rd largest is CR Snow (114), biggest of the Chinese giants that include Tsingtao (6th: 80), Yangjing (8th: 38) and Pearl River (21st: 12.5). These are largely owned by the Chinese government and are thought to have huge buying capacity

The four big Japanese brewers, Asahi (7th: 57), Kirin (13th: 28), Suntory (26th: 9) and Sapporo (29th: 8) rarely compete with each other for their global acquisitions

Multinational beer brands are usually owned by one company, but may be licensed to its “competitors” on a country-by-country basis, the rights to brew and / or distribute them changing hands fairly frequently, sometimes as a way of placating local regulators concerned about monopolies

Nowadays, the value of a large brewing company is determined largely by the theoretical value of its brands, research ideas and technology patents, rather than the amount of land, kit and property that it owns.

Defining what proportion of UK beer production comes from the four global brewers is made difficult by those last two bullet points. However, it is safe to say that at least 66% of the beer consumed is their brands. These companies hold a roughly one-third stake in the large PubCos, and exert additional control of the market through exclusivity and deep discount deals made with PubCos, supermarket and off-license chains, and others.

Trends: before COVID, beer production in the largest brewers’ core businesses had been reducing, slowly but steadily, for some years. They saw growth in low alcohol beers, ‘craft’ brands acquired through takeovers and investment, and had a few other niche successes but saw obvious reductions in sales of many of their bigger brand, commodity beers.

Independent breweries and their beers

General points:

The EU’s working definition of an independent brewery, for the purpose of defining eligibility for reduced alcohol duty, is “legally and economically independent of any other brewery”. Beyond such simplicity, agreement ends

So, if Beavertown is 49% owned by Heineken, is it still independent?

The biggest family-owned brewery in the world is Bordeaux-based BGI Castel (9th: 37), which owns dozens of breweries across Africa yet is still the junior partner in a wine business owned by the same family. Is that independent?

The largest UK-registered brewing company by volume is Diageo (14th: 26), the wines & spirits giant that owns Guinness. Should we consider it independent?

The second largest is assumed to be CK Asset Holdings (CKAH: formerly Greene King), though it no longer publishes its output volume. Smaller Hall & Woodhouse, Shepherd Neame and BrewDog, all came in around 0.4 million hl in 2019

For the purpose of these reports, “independent” will mean “smaller than Greene King and less than 20% owned by another brewery company”.

Pre-COVID, the UK had just under 2,000 independent breweries, of which around 1,750 were in regular production. A similar number had opened since 1980 and then shut again. Well over half of these independents produce(d) less that 2,000 hl pa, many concentrating on supplying their local area, often only with cask ale.

Those that had expanded beyond such a size did so broadly in three ways:

(i) striking regional and / or national distribution deals;

(ii) focusing on off-mainstream beer styles and formats using smaller containers – many dubbed “craft brewers”

(iii) reaching supply deals with smaller pub chains, either intended to be longer-term partners, or else to be linked companies that are separate legal entities.

Trends: after the turn of the millennium, beers from independent breweries struggled as much as the big brands, as drinkers’ preferences moved away from ‘a few pints at the local’ to ‘a few cans/bottles at home’. However, since around 2012, independents began to benefit, like brewers in the rest of the world, from the burgeoning interest in locally-made and specialty beers. Before this, the UK had been one of very few countries in the world where the proportion of beer being made by big breweries had been increasing.

Imports

The Brexit vote in 2016 had several immediate consequences. The most obvious was the 15% reduction in the value of Sterling against other major currencies. This has now become 20% and has yet to show any sign of improving post-Brexit. This has had the effect of raising the cost of imported beers.

Up to 2016, beer imports consisted mostly of bulk-buy, big-brand lagers, made more cheaply abroad. With the currency crash, the UK became a cheaper place in which to brew, as wages and other costs fell, relative to elsewhere. Beer imports dropped significantly and, to a lesser extent exports rose, leading to a small increase in production. This was sufficient to shore up the UK’s position as Europe’s 2nd and the world’s 9th largest beer producer, which had been threatened in recent years by both Poland and Spain.

A more careful look at the data reveals that pre-COVID, despite the fall in the value of Sterling, the importation of specialty beers appeared to increase somewhat. Once again, this reflected the rise of interest in off-mainstream, more interesting beers. These proved to be less price-sensitive, with drinkers more readily comparing their price to those of better wines, trending spirits and other up-market drinks.

At the time of writing, 5 weeks after the UK formally left the EU, the arrangements around tariffs on beer imports from / exports to mainland Europe remain unclear in some areas.

Trends: whether higher exports continue will depend on those import-export arrangements being clarified; whether Sterling recovers from its all-time low; and, at the special beers end, whether UK brands become coveted. What happens to up-market imports will depend largely on whether price sensitivity becomes a bigger issue post-COVID/Brexit; if climate concerns lead to new import tariffs; and how good UK brewers become at imitating Czech lagers, American IPAs and Belgian tripels.

Tim Webb

Vice-Chair (Beer), Real Ale Cider & Perry Campaigns Committee

Comments on contents are welcome at BelgiumGBG@aol.com

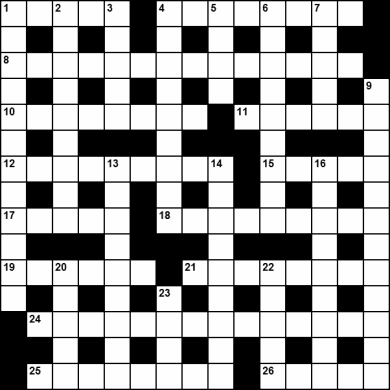

Non-Competition Crossword Hop Press index

(download printable pdf version here)

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

For this on-line edition the crossword is a non-prize one, for amusement (or masochism) only! Solution around June(ish).

Hop Press issue number 89 – Lockdown 2021

Editor: Pat O'Neill

1 Surbiton Road

Eastleigh

Hants.

SO50 4HY

023 8064 2246

hop-press@shantscamra.org.uk

© CAMRA Ltd. 2021

|

© 2026 CAMRA Ltd. All rights reserved. Campaign for Real Ale, Southern Hampshire Branch Pages supplied by & updated by the Webmaster: Pete Horn [View Site Disclaimer, Personal Data Handing, and Cookie information] [Site History] |